Same Old Story Continues !

I had indicated in the yesterday's post that failure to clear the 5550 -5560 level may see the Nifty futures testing the lows. It was also said that in the absence of any triggers, some back and forth trading may be expected. The kind of trading seen today morning also proves that this scenario is playing out so far. The reasons for this kind of trading are the following. ( a ) The medium term trend is still neutral to down due to the rising interest rates and inflation and the consequent slowing growth and profitability, ( b ) In spite of the aforesaid reasons warranting lower stock prices, the best of Indian stocks are still retaining somewhat premium valuations on the expectations of long term growth while most other stocks are still on a correction path, and ( c ) These diametrically opposite factors have lead to the sideways kind of trading and a breakout in either direction is beyond anybody's call right now.

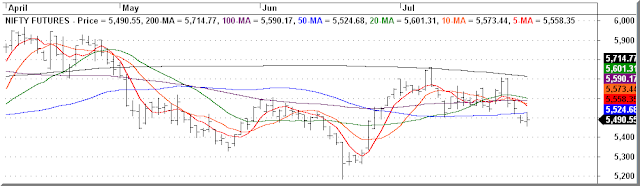

Nifty Futures Daily Chart