Back in the Old Trading Range ?

As indicated in the previous post that a short reversal might be in the making, Nifty future is testing the 5550 level today morning. Failure to clear the 5550 - 5560 level may still lead to a test of the lows. However, closes between the 50 DMA ( 5525 ) and the 100 DMA ( 5590 ) will indicate continuation of the trading range. As the Nifty futures are placed between important trend lines and various Moving Averages, some kind of two way trading will continue in the absence of any triggers. Therefore, all trend following systems, including the Momentum Signal will continue to whipsaw.

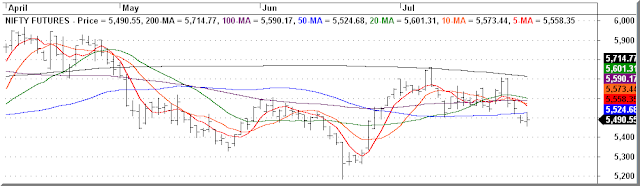

Nifty Futures - Moving Averages Chart

Nifty Futures Daily Chart