Signs of Profit Booking Again ?

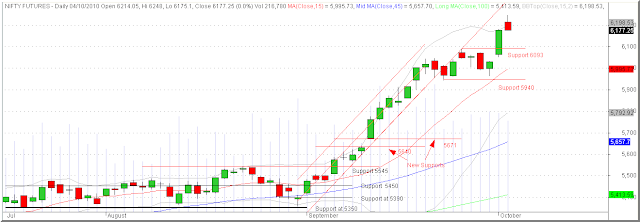

Nifty future was expected to open in the positive territory as a follow up of the momentum it showed on Last Friday. And as expected, Nifty futures opened higher at 6214 with a gap. After any higher open with a gap, all markets ( read traders ) face a question whether to trade in favour of the open or in the direction of the previous day's high and / or last traded price. ( In traders parlance this question is termed 'trade or fade ?' ) Anyway, the market initially decided to trade in the direction of the open ( towards new high ) on the back of momentum and went on to record a high of 6248. ( This high is very near to the channel breakout targets of 6250 - 6300 discussed earlier on this blog ). However, after recording a new high, market began to stall and the earlier mentioned question came to the fore, whether to continue the rally in a run away mode with daily gaps, ( Nifty futures recorded a gap on last Friday too ! ) or to fade the new high. On Monday, the first day of the new trading week, the sellers came and they booked profits or in the trader's parlance, they faded the new high. Please note that this blog had written in the previous post that in spite of a higher open on Monday, the markets may consolidate because the rally had already made gains of more than 200 points within a very short time of an hour and a trading day, in the fag end of the previous week. The profit booking and the mild selling continued till the close and the close of Nifty futures were at 6177. Monday's close as well as the low almost coincided with the previous week's last traded price.

Nifty Futures - Daily Chart

Monday's candle has it's tail placed on the top end indicating selling or profit booking at the higher ends. Except for the absence of gap, the candle even seems like an exact inverted mirror image of last Thursday's candle which also indicated support and start of the present leg of the uptrend from the low of 5963. In case of a mild correction or consolidation, Nifty futures may get support at the previous rally high of 6093.

As the US market indices were trading with losses of 1 to 1.25 % at the time of this post, Nifty futures may also open or trade lower on Tuesday morning. Re-entries in to an uptrend is always tricky and therefore it was pointed out in the last post that a reduction in the position limit is in order. While writing about this fact, yours truly has made a mistake of not clarifying what is meant by 'increased risk reward equation'. Actually, it is not an equation. It is a ratio. Even though it is called risk reward ratio, it is calculated by dividing the expected profit by the risk capital allocated to the trade. ( It must be called the reward risk ratio and not vice versa as it tries to calculate how many times profit is possible against each unit of risk capital allocated. )

Nifty Valuations

The above table shows the latest data related to Nifty historical valuations as seen from the NSE, India website. The trailing PE multiple of Nifty index is still quoting above the 25 mark. The historical price earning ( PE Ratio ), price to book value ( PB Ratio ) and dividend yield ( DY Ratio ) of the Nifty Index were at 25.61, 3.88 and 1.02 as on 4th October 2010. Readers may please note that the periods in which the Nifty index traded above a historical PE Ratio of 25 were limited to two occasions in the years 2000 and 2007-08. And both such periods coincided with highs just before the burst of the then bull markets. ( More information and analysis on Nifty historical valuation is available from the "Nifty Fundas" page of this blog ).

This information is being provided for the benefit of long term investors only. For traders, they can enjoy the rally till it lasts. It may be noted that markets can remain overvalued and overbought for significant periods which can be much beyond our expectations.

Updated Momentum Signal Spreadsheet

The updated spreadsheet showing the Momentum Signal as at the close of the trading on 4th October, 2010 is given below :

The Momentum Signal has indicated +50 values in respect of the Nifty Futures and the two tracked indices.

Projected Momentum Signal Close Values

The projected levels Momentum Signal values applicable to various ranges of closing values of the current month Nifty Futures, Nifty Index and the BSE Sensex, as at the close of next trading day, ie. as on 5th October, 2010, are given in the following table.

Please click on the table to enlarge. For more info on the above table, please click here.

Please do post your suggestions and comments on how this blog can be made more useful. To access and/or download the free online Position Limit Calculator click here.

To checkout the five year history of The Momentum Signal Spreadsheet click here

© 2010, momentumsignal.blogspot.com All rights reserved.

Disclaimer: No research, information or content contained herein or in the accompanied spreadsheet shall be construed as advice and is offered for information purposes only. We shall not be responsible and disclaim any liability for any loss, liability, damage (whether direct or consequential) or expense of any nature whatsoever which may be suffered by the user or any third party as a result of or which may be attributable, directly or indirectly, to the use of or reliance on any information or service provided. All files/information is provided 'as is' with no warranty or guarantee as to its reliability or accuracy.