The Unconfirmed Sell Signal Vanishes, But What Next ... ?

On Tuesday night, the US markets rallied to close with gains, after suffering heavy losses in the beginning of day's trading. By the time the Indian markets opened, the positive momentum from the US markets and the gains from the Chinese markets helped the Nifty futures to open higher at 5382. As is common these days, once the markets traded inside the prevailing trading range for some time, it even tried to test the range's highs too. The Nifty futures a traded to a high of 5411.9 just two ticks away from the Tuesday's high. As the European markets were trading steadily, the Nifty futures meandered inside the present trading range till the end. The Nifty futures closed at 5399.70 on Wednesday. The next direction of the market still seems to be tricky. Most heavy weights in the Nifty index are trading sideways. Now a days the markets are also trading with the historical valuations corresponding to previous normal bull markets highs. Hence the sluggish sideways trading. However, the markets still seem to be set for the next decisive move in the next few trading days.

Nifty Futures - Daily Chart

Any serious weakness in the international markets can still take down the Indian markets to lower levels sooner or later. Even if the markets were to trade higher, the upside seems to be capped to the 5500 to 5550 levels at present, for technical as well as fundamental reasons.

World Markets

On back of the overnight positive turnaround by the US markets, the European stock averages, the FTSE, CAC and DAX closed with gains of 1.46, 0.75 and 0.38 percents on Wednesday. The US markets were trading were absolutely flat till 11.30 PM IST. However, the US markets were moving in to negative territory at the time of this post following the written comments by the Fed Chairman Ben Bernanke in which he said the economic outlook was "unusually uncertain" and the Fed was prepared to take more actions if needed. ( Source : Market Watch ).

Updated Momentum Signal Spreadsheet

The updated spreadsheet showing the Momentum Signal as on the close of 21st July 2010, is given below.

The Momentum Signal has returned neutral values as on Wednesday.

Projected Momentum Signal Close Values

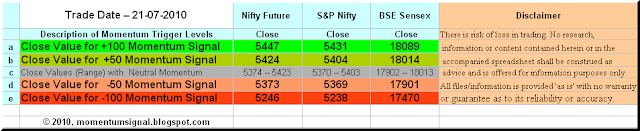

The projected levels of closing values corresponding to the momentum shift / neutrality / continuation as on the close of trading on 22nd July, 2010 are given in the table below. The table also include the projected closing values of BSE Sensex corresponding to the momentum shift / neutrality / continuation signals.

Please click on the table to enlarge. For more info on the above table, please click here.

Any close below the 5382, 5361 and 17909 by the Nifty Future, Nifty index and the Sensex on Thursday will result in the system indicating a sell signal. Since the markets are still in the narrow trading range, a close below the range is required to confirm the signal.

As the Momentum Signal is primarily a trend following system, it may indicate whipsaw signals in range bound markets. As such, all readers of this blog are requested to read the various pages describing the system and understand all the intricacies of trading the Momentum Signal and it's risk factors too. Please do write in your comments and suggestions.

Cheers and Prosperous Investing and Trading !!!

To access and/or download the free online Position Limit Calculator click here.

To checkout the five year history of The Momentum Signal Spreadsheet click here.

To access and/or download the free online Position Limit Calculator click here.

To checkout the five year history of The Momentum Signal Spreadsheet click here.

Disclaimer: No research, information or content contained herein or in the accompanied spreadsheet shall be construed as advice and is offered for information purposes only. We shall not be responsible and disclaim any liability for any loss, liability, damage (whether direct or consequential) or expense of any nature whatsoever which may be suffered by the user or any third party as a result of or which may be attributable, directly or indirectly, to the use of or reliance on any information or service provided. All files/information is provided 'as is' with no warranty or guarantee as to its reliability or accuracy.