Blue Chips Hold, But Mid & Small Caps Slide Continues !

As is expected after a deep fall, the international stock indices bounced back, and now, it seems that the process of testing the resistances are over. The next leg, naturally is a test of the panic lows. Since the Indian stock markets were already in a long drawn down trend, the losses were of lesser magnitude over here. And hence the smaller bounce. The bounce failed at the previous low cum resistance at the 5175 - 5225 level and thereafter, the Nifty index is in the process of finding value by testing the lower support. The 4950 - 5000 area being the panic low extends short term support for the time being. If the support holds, Nifty may again test the resistance area. Barring any major triggers, Nifty index may spend some time trading between the 5000 - 5175 area before the next leg of any directional movement. Meanwhile, some of lesser quality stocks may continue to slide.

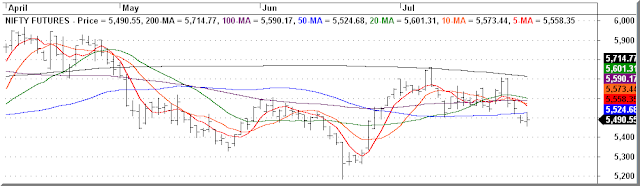

Nifty Futures Daily Chart

Nifty Trailing Fundamentals

Though, the major indices closed at a fourteen month low as on yesterday, the trailing valuation ratios of the Nifty index are just reaching the long term averages right now, as the trailing ratios were hovering at significantly higher levels of recently indicating over valuation.