The Reversal Leading to a Correction ?

As on yesterday's close, the Ultimate Momentum Signal closed in the neutral territory. The last buy signal was given by the system on 27th June, 2011 at a Nifty future level of 5537. This buy signal lead to maximum favorable excursion ( MFE ) or maximum profit opportunity of 223 Nifty points.

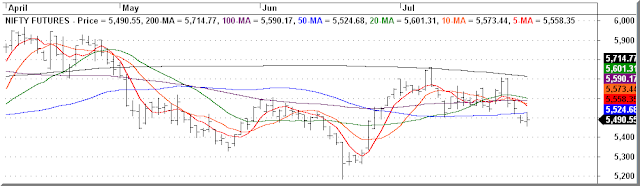

Meanwhile, as envisaged in all the three previous posts, Nifty future has returned to the lower support area of 5500 to 5550 level as a consequence of it's failure to break above the 5750 - 5760 resistance. Now the important question is whether the correction would continue or not. Irrespective of the outcome, the Momentum Signal seems to be poised to give a sell signal as on today's close unless the market makes a strong recovery intraday. In case the correction continues after some trials to fill the gap between yesterday's and today's trading ranges, the next support would be at the 5350 - 5400 levels where the lower boundary of the old trading channel is situated at present.

Nifty Futures - Daily Chart