Nifty Futures In the Green !

Nifty future has bounced back from the previously indicated support zone of 5350 - 5400, though the lower end of the zone was slightly broken on last Wednesday. Although it was indicated in the previous post that some of the stocks would be coming under negative pressure from the derivative expiry and therefore, the expiry would be near the strike of 5300, it was not be. This guess was made due to new selling seen in in the money (ITM) 5300 call options on last Wednesday. However, massive covering of ITM 5300 calls were seen during the trading of Thursday, right from the beginning, invalidating the previous guess.

Now the important question is whether the present bounce is a change of trend or not. At present it is difficult to predict, except for accepting the facts of the reasonable support of the 5350 - 5400 base and also the support of the lower boundary of the old trading channel. Moreover, trailing valuations are also at around the one and a half year lows. Therefore a rally to the middle of the trading channel can not be ruled out at present. Anyway lets see what the Momentum Signal indicates in the next few days !

Nifty Futures - Intra-day Chart

Nifty Futures - Daily Chart

Nifty Options Scene

The June series Nifty Options Put Call ratio ( PCR May series ) hovering at a very normal 1.34 times on Thursday. The PCR as such is not showing any negative bias to the market as of now.

Nifty Trailing Fundamentals

The trailing Price Earnings Ratio ( PE Ratio ), Price to Book Value ( PB Ratio ) and Dividend Yield ( DY Ratio ) of the Nifty Index were at 19.95, 3.40 and 1.25 respectively as on 26th May 2011. ( More information and a long term analysis on Nifty historical valuation are available from the "Nifty Fundas" page ).

Latest Ultimate Momentum Signal

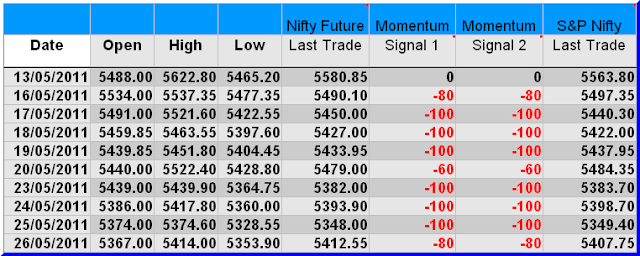

The Momentum Signal has remained in the negative momentum territory with a value of -80 as on Thursday.

The projected levels of Momentum Signal values applicable to various ranges of closing values of the current month Nifty Futures, Nifty Index and the BSE Sensex, as at the close of next trading day, ie. as on 27th May, 2011, are given in the following table. All readers are requested to take note that the table below is just a ready reckoner for the next day's Momentum Signal values and the figures are not intended to be interpreted as any targets for the Nifty futures or indices shown therein.

Click on the table above for an enlarged view.

Readers are also requested to go through The Signal, Entries and Exits, Position Limits, Risk Factors, Risk Analysis, and FAQs pages to gain a reasonable understanding of the trading system. Please do post your comments and suggestions on how new posts can be made more useful.

Cheers and Prosperous Investing and Trading !!!

To access and/or download the free online Position Limit Calculator click here. ( Please use the latest or updated browsers to access the Google Documents service. )

© 2010-2011, momentumsignal.blogspot.com All rights reserved.

Disclaimer: No research, information or content contained herein or in the accompanied spreadsheet shall be construed as advice and is offered for information and educational purposes only. We shall not be responsible and disclaim any liability for any loss, liability, damage (whether direct or consequential) or expense of any nature whatsoever which may be suffered by the user or any third party as a result of or which may be attributable, directly or indirectly, to the use of or reliance on any information or service provided. All files/information is provided 'as is' with no warranty or guarantee as to its reliability or accuracy. We do not recommend, promote, endorse or offer any guarantee whatsoever in respect of any services or products offered in the advertisements displayed on the site by Google AdSense.

No comments:

Post a Comment