Another Day of Losses, But What Now ?

- Last Thursday, Nifty Futures bounced back after making losses in five out of the six previous trading sessions and closed very near to the resistance at 5550.

- It seemed that some more upside might be forthcoming on Friday on the back of the previous day's momentum.

- On Friday, markets opened slightly lower, but tried to continue with the upward movement in the morning session.

- After hovering between 5540 and 5510 for an hour or so, Nifty futures broke above the resistance level of 5550.

- However, the breakout lacked follow up buying and it turned out to be a real bull trap.

- Once Nifty futures broke below the 5550 level again, all round selling started and the contract reached the lower reference level of 5450.

- Another bout of selling in the last hour of trading saw the Nifty contracts recording a new swing low of 5356, which almost coincided with the already indicated minor support between 5340 and 5350.

- Nifty futures closed for the week at 5382.

Nifty Futures - Intra-day Chart

Nifty Futures - Daily Chart

- Another bearish engulfing candle is seen the daily chart of the Nifty contracts. This candle covers the range of previous four trading days.

- Six month low of Nifty futures is at 5340. Therefore, the chances the contract finding some minor or short term support at this level is possible.

- The lower support is at the 5200 -5250 levels. Even if the Nifty futures arrests it's fall at the 5350 level, 5450 and 5550 levels may act as resistances in the short term.

S&P CNX Nifty Index - Weekly Chart

- The weekly chart of Nifty index given above covers a period of an year.

- The old trading channel is seen on the left side of the chart. Nifty broke above this trading channel in the month of September, 2010.

- The index traded in the new ( upper ) trading channel for the rest of the year.

- Nifty has again fallen in to the old trading channel as seen on the right end of the chart.

- As such, there is very high probability of the index testing the lower boundary of old trading channel in the medium term. The support from this lower boundary is available at an index level of 5140 for the coming week.

- Market may also test the lower boundary more than once just as happened at the top. In case the market visits the lower boundary after a month or two, the boundary itself may move upward and therefore, the support may also move up.

- No one knows for sure about where the market may make a low and reverse. Therefore, all the supports and resistances given on this site are only of interim nature and market always find it's own levels and reverses from there when the majority do not expect it to reverse.

- The only certainties which can be surmised at present are : ( a ) We are still in the that part of the cycle in which inflation and interest rates are rising, and ( b ) Market is still trying to find it's own levels and is on a medium term downtrend.

Nifty Options Scene

Following the sell off on Friday, the February series Nifty Options Put Call ratio ( PCR ) decreased further to 0.92 times on Friday. The India VIX closed higher at 24.41, up7.58 %. Significant call writing ( increase in open interest ) was seen at the strike at 5400. Some Call writing was also seen at strikes at 5300 and 5500. The highest open interest ( OI ) of February series Nifty Call options has remained unchanged at the 5500 strike. The highest February series Put options OI was at the 5400 strike as on Friday. Significant additions to Put OI were also seen at the strike at 5200 whereas massive covering of short Put options were seen at the 5500 strike. This option OI data seems to suggest that market participants are expecting the market to trade in a wide range between 5100 and 5600 in the near term. Therefore, Nifty future may become more volatile in the immediate future. However, these indications may change any time before the expiry in accordance with the changes in the market,.

Nifty Trailing Fundamentals

The trailing PE multiple of Nifty index has again moved below the 21 mark. The trailing Price Earnings Ratio ( PE Ratio ), Price to Book Value ( PB Ratio ) and Dividend Yield ( DY Ratio ) of the Nifty Index were at 20.67, 3.53 and 1.15 respectively as on 4th February 2011. ( More information and a long term analysis on Nifty historical valuation are available from the "Nifty Fundas" page ).

Latest Ultimate Momentum Signal

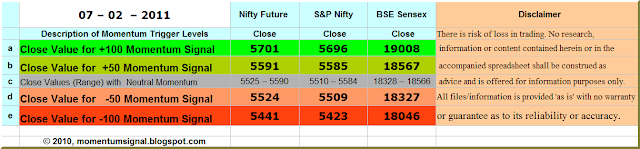

Momentum Signal has again closed at -100 area for the day.

Projected Momentum Signal Close Values

The projected levels of Momentum Signal values applicable to various ranges of closing values of the current month Nifty Futures, Nifty Index and the BSE Sensex, as at the close of next trading day, ie. as on 7th February, 2011, are given in the following table. All readers are requested to take note that the table below is just a ready reckoner for the next day's Momentum Signal values and the figures are not intended to be interpreted as any targets for the Nifty futures or indices shown therein.

Please click on the table to enlarge. For more info on the above table, please click here.

Readers are requested to go through The Signal, Entries and Exits, Position Limits, Risk Factors, Risk Analysis, and FAQs pages to gain a reasonable understanding of the trading system. Please do post your comments and suggestions on how new posts can be made more useful.

Cheers and Prosperous Investing and Trading !!!

To access and/or download the free online Position Limit Calculator click here.

To checkout the five year history of The Momentum Signal Spreadsheet click here

© 2010-2011, momentumsignal.blogspot.com All rights reserved.

Disclaimer: No research, information or content contained herein or in the accompanied spreadsheet shall be construed as advice and is offered for information and educational purposes only. We shall not be responsible and disclaim any liability for any loss, liability, damage (whether direct or consequential) or expense of any nature whatsoever which may be suffered by the user or any third party as a result of or which may be attributable, directly or indirectly, to the use of or reliance on any information or service provided. All files/information is provided 'as is' with no warranty or guarantee as to its reliability or accuracy. We do not recommend, promote, endorse or offer any guarantee whatsoever in respect of any services or products offered in the advertisements displayed on the site by Google adsense.

No comments:

Post a Comment