Derivative Expiry Over, But What Now ?

Profit of 140 Points in the Last Trade : This author is happy to announce that, on expiry of the December series Nifty futures contracts, the last buy signal indicated by the Momentum Signal Nifty trading system has made a profit of 140 points. For non-regular readers of this blog, here is a retake. The last buy signal in the Nifty futures was indicated by the Momentum Signal trading system on 16th December, 2010 at the 5960 level. Since the contract expired at 6103, the long position has made a profit of 140 points in the December series Nifty futures. Now, here are the best things about the trading system. It comes free. It does not require any registration or payments. Just check the updates to find when the momentum shifts and follow the trade management rules availble on the site. The Momentum Signal values applicable to various closing values / ranges of Nifty futures, S&P Nifty and BSE Sensex are also made available one day before the trade date.

Nifty futures opened flat on Thursday and immediately went in to the positive territory. However, as is usual in these low volume low volatility markets, the gains were limited. The contract kept on trading below the 6090 reference level for most of the morning session. Unable to break above the 6090 level, Nifty futures also tried to test the supports, in the middle of the morning session. However, it recovered from the adjusted close of the previous day. In the last half an hour of trading, Nifty futures broke above the 6090 level and closed at 6103.

Nifty Futures - Intra-day Chart

Nifty Futures - Daily Chart

The December month Nifty future contract has closed just above the 6090 resistance. The January month contract was trading at 6127 at the close of trading. The indices, both S&P Nifty and BSE Sensex have already closed above their previous swing highs. If Nifty future is able to keep trading above 6090 levels in the next few trading days, it may reach the next resistance at the 6175 level. It seems that the mild positive momentum may continue for some more time if some of the lagging sectors also join the rally in the January series. However, factors like the extended valuations, tight liquidity, high inflation, rising interest rates etc. may act as hindrances to the positive scenario. Traders may refer to the previous post for a detailed list of important reference levels for intraday analysis and trading.

Nifty Option Scene

The January series Nifty options Put Call ratio was at a reasonably normal level of 1.56 as on the day. The highest open interest ( OI ) of Put options is at the 6000 strike. And the highest number of Nifty Call option OI is at the 6100 strike. The 6200 strike also held a similar number of Call option OI, indicating a market range between 6000 and 6200 in the immediate future. The India VIX also fell to 17.04, indicating the mild positive outlook.

Nifty Trailing Fundamentals

The trailing Price Earnings Ratio ( PE Ratio ), Price to Book Value ( PB Ratio ) and Dividend Yield ( DY Ratio ) of the Nifty Index were at 24.35, 3.85 and 1.02 respectively as on 30th December 2010. ( More information and a long term analysis on Nifty historical valuation are available from the "Nifty Fundas" page ).

Latest Ultimate Momentum Signal

Nifty futures and both the indices, viz. S&P Nifty and BSE Sensex have closed with Momentum Signal values of +100 as on Thursday.

Projected Momentum Signal Close Values

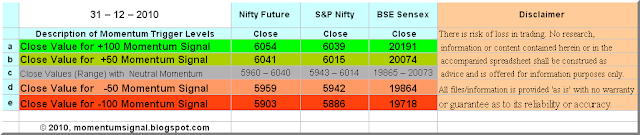

The projected levels of Momentum Signal values applicable to various ranges of closing values of the current month Nifty Futures, Nifty Index and the BSE Sensex, as at the close of next trading day, ie. as on 31st December, 2010, are given in the following table. All readers are requested to take note that the table below is just a ready reckoner for the next day's Momentum Signal values and the figures are not intended to be interpreted as any targets for the Nifty futures or indices shown therein.

Readers are requested to go through the Risk Factors, Risk Analysis, Position Limits and FAQs pages to gain a reasonable understanding of the trading system. Please do post your comments and suggestions on how new posts can be made more useful.

Cheers and Prosperous Investing and Trading !!!

To access and/or download the free online Position Limit Calculator click here.

To checkout the five year history of The Momentum Signal Spreadsheet click here

Disclaimer: No research, information or content contained herein or in the accompanied spreadsheet shall be construed as advice and is offered for information and educational purposes only. We shall not be responsible and disclaim any liability for any loss, liability, damage (whether direct or consequential) or expense of any nature whatsoever which may be suffered by the user or any third party as a result of or which may be attributable, directly or indirectly, to the use of or reliance on any information or service provided. All files/information is provided 'as is' with no warranty or guarantee as to its reliability or accuracy. We do not recommend, promote, endorse or offer any guarantee whatsoever in respect of any services or products offered in the advertisements displayed on the site by google adsense.

2 comments:

You makes us easily understand each and every market moves about the stock market by giving us Nifty Future Tips updates and also explaining this through a simple chart.

After reading your blog posts and also taking tips from Epic Research Private Limited, trading seems easy to me.

Post a Comment