Another Sell Signal, But What Next ... ?

The Nifty Futures opened positively on the back of overnight gains in the Wall Street and the positive cues from the Asian markets on Tuesday. The Nifty futures achieved a high of 5412 at the start of trading itself and thereafter, started the slow grinding downward movement. The down movement accelerated towards the fag end of trading and the Nifty futures traded last at 5353, very near to the day's low of 5350. The underlying index too closed at 5353.65 on the last trade basis. As the closing prices of the futures and the index are calculated by finding the last half an hour's average price by the NSE, the closing prices disseminated by the exchange are much higher than the last traded prices of Tuesday. The Momentum Signal has indicated a sell on the basis of the last traded price of the Nifty futures. However, no confirming signal has been available on the basis of the Nifty index and Sensex so far. As already been repeatedly written in the last posts, the market seems to be poised for decisive move in the next few days. At present, the confirmation of the sell signal seems to be most possible outcome.

Nifty Futures _ Daily Chart

The Nifty future has marginally broken both the support lines. However, the Nifty and Sensex are yet to break their corresponding support lines. The reason for these anomalies are accounted by the changes in the premium and discount in the prices of the futures in comparison with the Nifty index. As already stated in the previous posts, the Nifty futures have minor supports at the 5300 and 5225 levels. These levels are capable of only providing minor supports. At present a larger and deeper correction can not be ruled out too. This is because of the markets inability to go past the previous highs and the fluid economic conditions available in most markets.

World Markets

The European market indices, the FTSE, CAC and DAX closed with losses of 0.17, 0.53 and 0.69 percents. The US market indices opened with deep losses and were on the recovery path with losses of 0.30 to 0.60 percents at 11.30 PM IST.

Updated Momentum Signal Spreadsheet

As already discussed, a sell signal has been indicated on the last traded prices of the futures. However this sell signal has not yet been confirmed by any corresponding signals for the Nifty index and the BSE Sensex. However, an exit of long positions were indicated by all the three as on Tuesday. ( In fact the exit was hinted by the Sensex a day earlier. )

Projected Momentum Signal Close Values

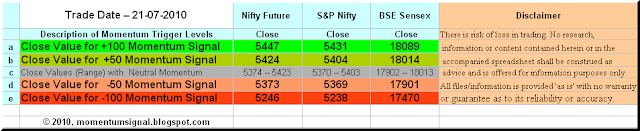

The projected levels of closing values corresponding to the momentum shift / neutrality / continuation as on the close of trading on 21st July, 2010 are given in the table below. The table also include the projected closing values of BSE Sensex corresponding to the momentum shift / neutrality / continuation signals.

Any close below the 5373, 5369 and 17901 by the Nifty Future, Nifty index and the Sensex on Wednesday will confirm the tentative sell signal obtained on the last trading day.

As the Momentum Signal is primarily a trend following system, it may indicate whipsaw signals in range bound markets. As such, all readers of this blog are requested to read the various pages describing the system and understand all the intricacies of trading the Momentum Signal and it's risk factors too. Please do write in your comments and suggestions.

Cheers and Prosperous Investing and Trading !!!

To access and/or download the free online Position Limit Calculator click here.

To checkout the five year history of The Momentum Signal Spreadsheet click here.

To access and/or download the free online Position Limit Calculator click here.

To checkout the five year history of The Momentum Signal Spreadsheet click here.

© 2010 momentumsignal.blogspot.com All rights reserved.

Disclaimer: No research, information or content contained herein or in the accompanied spreadsheet shall be construed as advice and is offered for information purposes only. We shall not be responsible and disclaim any liability for any loss, liability, damage (whether direct or consequential) or expense of any nature whatsoever which may be suffered by the user or any third party as a result of or which may be attributable, directly or indirectly, to the use of or reliance on any information or service provided. All files/information is provided 'as is' with no warranty or guarantee as to its reliability or accuracy.

No comments:

Post a Comment